One of the most common questions we get here at Theannoni Center for Plastic Surgery is whether or not insurance will cover rhinoplasty. Unfortunately, this is a difficult question to answer because it really depends on each individual’s insurance policy. However, there are a few things you can do to try and get your insurance to cover your surgery.

First and foremost, you need to check with your insurance company to see if they have any coverage for cosmetic surgery. Most companies will not cover elective surgery, but there are some that will make exceptions for certain procedures. If your insurance company does have coverage for cosmetic surgery, they will likely require that you get pre-authorization before moving forward with the procedure.

Will Insurance Pay for a Rhinoplasty?

- Check with your insurance company to see if they cover rhinoplasty surgery

- If your insurance company does cover rhinoplasty, find out what is required for coverage

- Get a referral from your primary care physician or ENT specialist

- Schedule a consultation with a board certified plastic surgeon who specializes inrhinoplasty surgery

- During your consultation, discuss your goals and concerns about the procedure

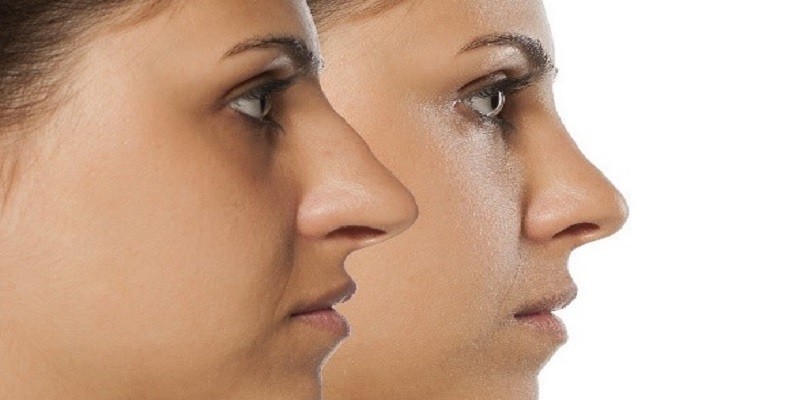

- The surgeon will examine your nose and take photographs

- The surgeon will develop a surgical plan and give you an estimate of the cost of the procedure, which will include surgical fees, anesthesia fees, facility fees, and other associated costs such as post-operative care and follow-up appointments

How to Get Rhinoplasty Covered by Insurance Reddit

If you’re considering rhinoplasty, you may be wondering if your insurance will cover the cost. Unfortunately, insurance companies typically don’t cover cosmetic procedures like this one. However, there are a few ways you can try to get them to cover at least part of the cost.

First, check with your insurer to see if they have any exceptions for coverage of cosmetic surgery. Some insurers will make an exception for cases where the surgery is medically necessary, such as when it’s needed to improve breathing or correct a birth defect. If your case falls into this category, you’ll need to get documentation from your doctor supporting this before trying to submit a claim.

Another option is to see if your employer offers any type of flexible spending account (FSA) that could be used to cover the cost of the procedure. This is a pre-tax account that can be used for medical expenses not covered by insurance. You’ll need to check with your employer about eligibility and how much you can contribute per year.

Finally, some surgeries can be considered “self-pay” and may not require insurance coverage at all. In these cases, you would simply pay for the surgery out of pocket and would not submit a claim to your insurer. This is usually only an option for more minor procedures though, so it’s unlikely that rhinoplasty would qualify as self-pay.

If you’re hoping to get rhinoplasty covered by insurance, your best bet is probably going to be finding an exception or using an FSA account if possible. However, even in those cases it’s likely that you’ll still have to pay at least part of the cost yourself.

Credit: www.ohsu.edu

How Do I Afford a Nose Job?

There are a few options available to help finance a nose job. One is to take out a personal loan, which can be done through a bank or online lender. Another option is to use a credit card, though this should be used as a last resort because of the high interest rates associated with credit cards.

There are also surgery financing companies that offer loans specifically for cosmetic procedures. These loans typically have lower interest rates than traditional loans and may even offer deferred payment plans, meaning you don’t have to make any payments until after the surgery is completed.

Does Insurance Cover Revision Rhinoplasty?

There are a lot of variables to consider when asking if insurance will cover revision rhinoplasty. The first is what kind of insurance you have. If you have private insurance, they may be more willing to cover the procedure than if you have public insurance.

The second is what your policy says about coverage for elective procedures. Some policies are very clear that they will not cover any cosmetic surgery, while others may have some wiggle room for revision surgery if it is deemed medically necessary.

The third factor is why you are needing revision surgery in the first place.

If it is due to something that was out of your control, such as an injury, then you may have a better chance of getting coverage than if you are simply unhappy with the results of your original surgery. Your surgeon will be able to help guide you on this and provide documentation to support your case for coverage.

ultimately, whether or not your insurance will cover revision rhinoplasty depends on a variety of factors.

It is always best to check with your insurer beforehand so that there are no surprises down the road.

Does Rhinoplasty Have Payment Plans?

Rhinoplasty, or nose surgery, is a popular cosmetic procedure that can correct a number of aesthetic concerns. Because rhinoplasty is considered elective surgery, most insurance companies will not cover the cost. However, this doesn’t mean that you have to pay for your entire procedure up front.

Many surgeons offer financing options or payment plans to help make nose surgery more affordable.

If you’re considering rhinoplasty but are concerned about the cost, talk to your surgeon about financing options. They may be able to work with you to create a payment plan that fits your budget.

There are also a number of third-party lenders that offer financing for cosmetic procedures like rhinoplasty. CareCredit is one such lender; they offer low- and no-interest financing options depending on your credit history and financial situation.

Whether you finance your rhinoplasty through your surgeon or a third-party lender, it’s important to make sure you understand all the terms of the agreement before signing anything.

This includes understanding how much interest you’ll be charged (if any), what the monthly payments will be, and when the loan needs to be paid off in full. By carefully reviewing all the paperwork beforehand, you can avoid any surprises down the road and ensure that you’re comfortable with the repayment terms.

Does Insurance Cover Septorhinoplasty?

Septorhinoplasty, also known as nasal reconstruction or a nose job, is one of the most common plastic surgery procedures. And while it’s usually considered a cosmetic procedure, it can also be done for medical reasons, such as to correct a birth defect or to improve breathing.

So, does insurance cover septorhinoplasty?

It depends on the reason for the surgery and your individual insurance plan. If the surgery is being done for medical reasons (such as to improve breathing), then it’s more likely that your insurance will cover at least part of the cost. But if it’s being done purely for cosmetic reasons, then it’s unlikely that insurance will cover any of the costs.

Of course, even if your insurance company doesn’t cover septorhinoplasty, that doesn’t mean you can’t have the surgery. You’ll just need to pay for it yourself. The cost of septorhinoplasty varies depending on the surgeon and the extent of the surgery, but it typically ranges from $3,000 to $10,000.

Conclusion

If you are considering rhinoplasty, also known as a nose job, you may be wondering if your insurance will cover the procedure. Unfortunately, most insurance companies do not cover cosmetic surgery, including rhinoplasty. However, there are some exceptions.

If your doctor determines that your nose is causing you functional problems, such as difficulty breathing, then your insurance may pay for part or all of the surgery. In addition, if you have suffered an injury to your nose that has caused deformity, your insurance may also cover reconstructive surgery.

If you are hoping to get rhinoplasty covered by insurance, it is important to consult with your doctor and insurer ahead of time to find out what documentation and pre-authorization may be required.

Even if your insurance does not cover the entire cost of the surgery, they may still provide some coverage for related expenses such as anesthesia or hospital stay.