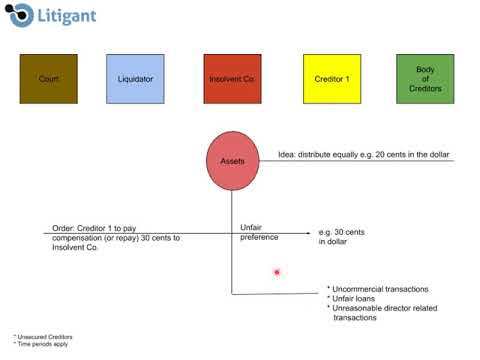

A voidable transaction is repayment of money, transfer of property, or other transaction from the company’s assets to a relevant or unconnected third party that either takes place at once when the company was insolvent or otherwise triggers a detriment to the company.

If a liquidator identified voidable transactions during the winding up of a company, the liquidator would recover from the parties or financial institutions that take advantage of the voidable deals by providing a letter of demand, which can lead to court proceedings.

Read More – Things to Consider When Choosing a Skip Hire Company

Suppose you have received a letter issued by a liquidator asking for that you repay specific cash on the basis that they are voidable deals. In that case, you need to contact right away from our team of business insolvency specialists, who can help you understand:

Whether the transaction is a voidable; Your legal rights and also responsibilities when being checked out about a voidable transaction; as well as Whether there is a defense available to directors and creditors of a company who have made or taken advantage of a voidable transaction.

When interior checks make the bank aware of a winding-up request advert, they will immediately freeze all accounts in the wind up company. They do this to safeguard their lawful setting, minimizing their own risk of guilt.

This also assists protect the company’s cash at the bank for any future selected liquidator.

If a company requires the use of the bank accounts for a bonafide factor, they will certainly need to instigate their very own court-based legal process to thaw the bank accounts.

This procedure is described as an application for a validation order.

What is the validation order?

The crucial part of the regulation is that deals made after a winding-up petition have been offered are void personalities unless the court orders. It is possible to get a validation order to permit some settlements to be made.

Procedure to obtain a validation order?

To request a validation order, you will likely require the aid of a solicitor specializing in bankruptcy. Depending upon your exit path from the ending up request, you will need an insolvency practitioner.

Your solicitor will prepare an application in your place and a witness statement to layout your evidence as to why the recognition order needs to be granted.

Historically, a variety of celebrations have looked for to get a recognition order retrospectively when the liquidator or official receiver has looked for to recuperate voidable transactions.

Previously, purchases carried out in the organization’s normal course would be confirmed by the court retrospectively.

Read More – Simple Tips for Boosting Sales on Amazon

However, recent case law has established a much higher requirement.

Validation orders for potential gap settlements need to be sought ahead of the repayments being made. If not, there is a severe risk of liabilities on the director’s recipient and personal responsibility.

Final Verdict

It deserves keeping in mind that a recognition order is frequently a spot for more massive trouble. Unless you can pay the request financial obligation and continue to run your organization as a going issue, you may wish to think about alternate bankruptcy treatments.

You need to do so ahead of the ending up order being made to control the circumstance. Suppose you are having difficulties with a winding-up petition and a frozen bank account. In that case, our service rescue professionals can help you take the immediate activity needed to solve your scenario.